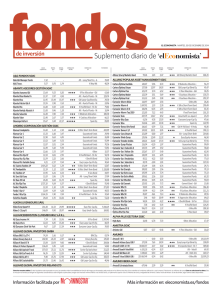

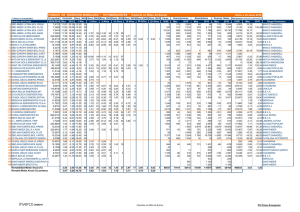

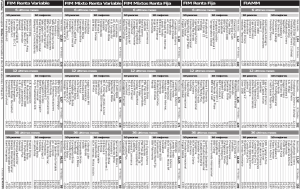

Fondos - elEconomista.es

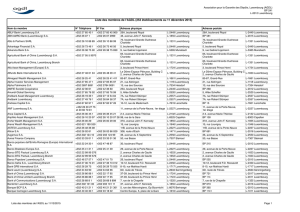

Anuncio