Finance and investment

Anuncio

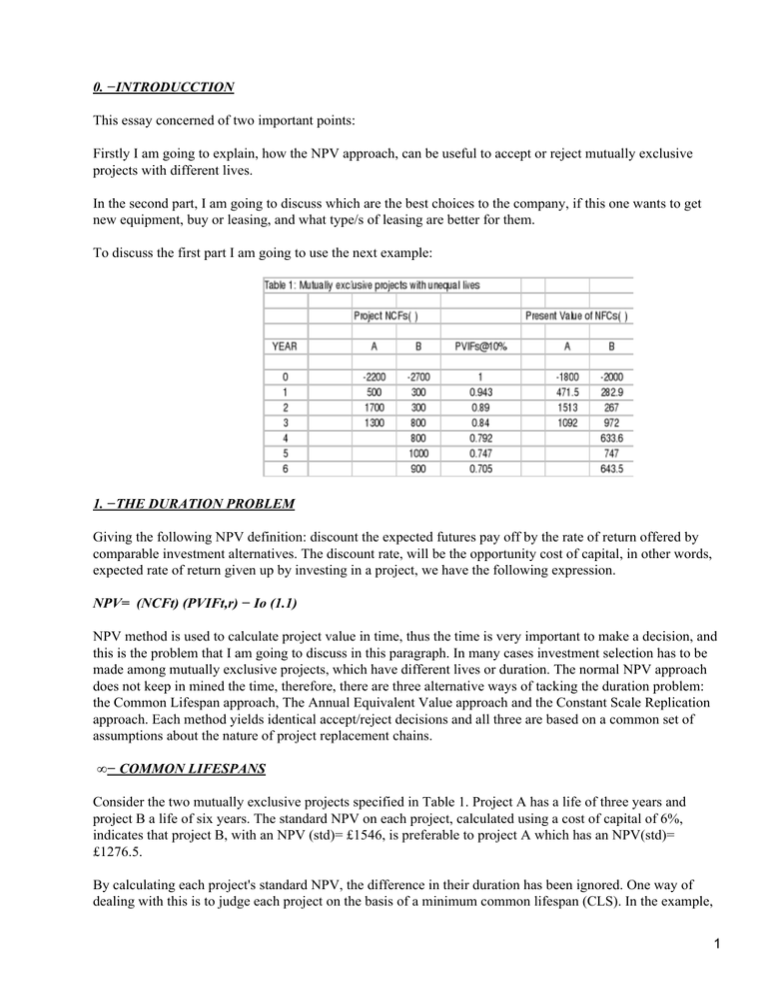

0. −INTRODUCCTION This essay concerned of two important points: Firstly I am going to explain, how the NPV approach, can be useful to accept or reject mutually exclusive projects with different lives. In the second part, I am going to discuss which are the best choices to the company, if this one wants to get new equipment, buy or leasing, and what type/s of leasing are better for them. To discuss the first part I am going to use the next example: 1. −THE DURATION PROBLEM Giving the following NPV definition: discount the expected futures pay off by the rate of return offered by comparable investment alternatives. The discount rate, will be the opportunity cost of capital, in other words, expected rate of return given up by investing in a project, we have the following expression. NPV= (NCFt) (PVIFt,r) − Io (1.1) NPV method is used to calculate project value in time, thus the time is very important to make a decision, and this is the problem that I am going to discuss in this paragraph. In many cases investment selection has to be made among mutually exclusive projects, which have different lives or duration. The normal NPV approach does not keep in mined the time, therefore, there are three alternative ways of tacking the duration problem: the Common Lifespan approach, The Annual Equivalent Value approach and the Constant Scale Replication approach. Each method yields identical accept/reject decisions and all three are based on a common set of assumptions about the nature of project replacement chains. • − COMMON LIFESPANS Consider the two mutually exclusive projects specified in Table 1. Project A has a life of three years and project B a life of six years. The standard NPV on each project, calculated using a cost of capital of 6%, indicates that project B, with an NPV (std)= £1546, is preferable to project A which has an NPV(std)= £1276.5. By calculating each project's standard NPV, the difference in their duration has been ignored. One way of dealing with this is to judge each project on the basis of a minimum common lifespan (CLS). In the example, 1 the minimum CLS is six years, implying that project B should be compared with project A, on the assumption that project A is repeated or replicated once, beginning at the end of the year three. The new cash flow profile for project A, and its replication, is giving table 2. The NPV (CLS) of project B is as before (£1546), since it does not need to be replicated. Under the CLS approach, however, the NPV (CLS) for project A is £2346.6, indicating that project A should be accepted and not project B. Under the CLS approach, project A's replication begins at the end of period three on the assumption that: • Its technological characteristics have not changed; • Its initial costs, at the end of the three year, are identical to those in year zero; and • Its subsequent cash flows over years four to six are identical to those over year one to three. The problem of this method is that this approach would be tedious to calculate, mainly if we have a long horizon time. 1.2− ANNUAL EQUIVALENT VALUE Under the Annual Equivalent Value approach (AEV), the standard NPV of each project is calculated and, the question is asked: what constant annual sum of money (the AEV), paid over the life of the project, would have given rise to this project's NPV?. In other words, the constant annual NCF is found which is equivalent to the NPV on the project. For mutually exclusive projects, the project with the highest AEV is accepted. In effect the AEV approach applies the annuity principle, where: NPV9Std) = AEV[PVIFAt,r] Therefore, AEV = NPV(Std)/PVIFAt.r 1.3− CONSTANT SCALE REPLICATION The Constant Scale Replication (CSR) approach is similar to the Common Lifespan approach; however, instead of taking a minimum common lifespan, CSR assumes that projects are replicated to infinity, and calculates NPV under these conditions. 2 The NPV under CSR is obtained from the following formula: NPV(CSR) = NPV(Std.)/(1−PVIFt,r) That is assuming that the replacement chain of a project goes to infinity, NPV(CSR) is equal to the standard NPV of a project divided by one minus the present value interest factor for t periods (the initial life of the project) at r. 1.4− IMPLICATIONS These three methods of investment appraisal are closely interrelated. The relationship between the minimum Common Lifespan and Constant Scale Replication approaches is obvious. The former determines a minimum common lifespan and calculates each project's NPV on this basis.The latter takes the common lifespan to infinity. Constant Scale Replication is directly linked to Annual Equivalent Values, with the AEV of a project being equal to the discount rate times its NPV(CSR): AEV = r[NPV(CSR)] Any of these approaches can be used. On balance, companies tend to favour Annual Equivalent Value when they view differences in project duration as being important. As it has been shown, however, use of the AEV implies Constant Scale Replication, the generalisation of the Common Lifespan approach. The latter is based on the restrictive assumptions that the initial costs, subsequent cash flows and technological characteristics of the initial project remain the same over each replication. Thus using AEV implies that these hold over an infinite series of replications. These assumptions may not hold when making comparison between projects. Particular projects may be more adaptable to anticipated technological change, some may have rates of cost inflation which will vary over the business cycle and some may be more easily expanded or contracted in the future in response to unanticipated demand changes. If these types of project are identified, such factors must be accommodated as best they can in the appraisal process and in arriving at a particular measure of investment worth. 2. − LEASING Given a small construction firm that has been in operation only a short time has received its first large and long−term construction contract. This contract requiressome specialist equipment. This equipment has a long lifespan and can be used again. 2.1 − TIPES OF LEASES A lease involves two parties − the owner of the asset,who buys it and leases it out − and the user of the asset, who use the asset during the life of the lease. The first party, the lessor, charges the second party, the lessee, an agreed upon charge − a lease payment − in very period. Although this is the typical structure, leases take a number of different forms, with different implications for ownership and tax benefits to both parties. OPERATING or SERVICE LEASE It is usually signed for a period much shorter than the actual life of the asset, and the present value of lease payments is generally much lower than the actual price of the asset. At the end of the life of this lease, the equipment reverts back to the lessor, who will either offer to sell it to the lessee or lease it to somebody else. The lessee usually has the option to cancel the lease and return the asset to the lessor. Thus, the ownership of 3 the asset in an operating lease clearly resides with the lessor, with the lessee bearing little or not risks if the asset becomes obsolete. FINANCIAL or CAPITAL LEASE It generally lasts for the life of the asset, with the present value of lease payments covering the price of the asset. A financial lease generally can not be cancelled, and the lease can be renewed at the end of its life at a reduced rate or the asset can be acquired at a favourable price. In many cases, the lessor is not obligated to pay insurance and taxes on the asset, leaving these obligations up to the lessee. Consequently, the lessee reduces the lease payments, leading to what are called net leases. In summary, a financial lease imposes substantial risk on the lessee. 2.2 − SUGGESTION TO THE FIRM Considering that the firm has been in operation a short time, I don't recommended the financial lease unless the company has a good expected about its futures long−term construction contracts. With the operating lease, the firm can carry out its actual project, and cancel the lease if it has not more contracts. With operating lease, the firm takes less risk, because with the financial lease, it have to pay all the insurance and tax, and it can not cancel the lease before the end of the contract. 2.3 − TO BUY or TO LEASE A comparison of the relative costs of leasing through a finance lease and purchase through a bank loan is in practice a very complicate calculation. My recommendation is that the firm should chooses the operative lease and this opinion is based in the following questions: A − the company is too young and they don't need to make a high outlay buying the equipment, because the firm are beginning. B − choose lease form depend of the loan bank interest ratio, and the interest ratio of the lease. In all ways, leasing is better because the company's profit will be lower and they will pay less tax. C − As the company it is very young, they don't know the growth expectations and it is not necessary to invest in very expensive equipment it stops then not to use it. To evaluate what is better, buy or lease, following the principles of investment appraisal, we have the following expression: NAL = Io − IAT / [ 1 + r(1 − Tc)]t NAL is the Net Advantage Leasing. IAT is the Incremental After Tax. Accept/reject conditions given assets i: NALi > 0 NALi < 0 NALi = 0, if this, the company buy the equipment because Io < cost of purchase. 4 Discount rate is determining the NAL would be the required rate of return on debt of he same maturity and risk as the lease. 1 5